Goldwasher

Gold Member

- May 26, 2009

- 6,077

- 13,225

- 🥇 Banner finds

- 1

- Detector(s) used

- SDC2300, Gold Bug 2 Burlap, fish oil, .35 gallons of water per minute.

- Primary Interest:

- All Treasure Hunting

*Weep

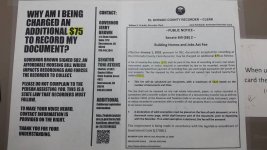

The new recording tax does apply to claims filings.

$75 minimum per document.

First year filings will add $150 bucks

Lame.

I saw the notice on the counter and asked to be sure.

The new recording tax does apply to claims filings.

$75 minimum per document.

First year filings will add $150 bucks

Lame.

I saw the notice on the counter and asked to be sure.

Amazon Forum Fav 👍

Attachments

Last edited:

Upvote

0