Red James Cash

Banned

- Aug 20, 2009

- 12,824

- 7,899

- Detector(s) used

- Garret Master hunter Cx Plus

- Primary Interest:

- Other

The Grand Deception In the Precious Metals Industry

Filed in Mining, Precious Metals by SRSrocco on April 3, 2014

Many precious metals investors are being deceived and they don’t even know it. There is so much fraud, manipulation and deceit taking place in the economic and financial markets, its amazing the system hasn’t collapsed already.

However, there is another big problem taking place in the precious metal industry that has frustrated me to no end. This is what I call the “Grand Deception.”

Let me explain…

The market sentiment in the precious metals is at an all-time low. Banks and brokerage houses are now coming out with the typical “Gold’s going to $1,000 or below forecasts.” Then we had this GEM from the wonderful folks at Natixis, “$10/oz Silver in 2015 Among Natixis Scenarios.”

$10/oz silver in 2015 among Natixis scenarios - GOLD NEWS - Mineweb.com Mineweb

With the current low price of gold and silver, including all the negative press coming from MSM, many precious metals investors are increasingly frustrated and concerned about their metal investments.

One of the major problems as I see it, is the confusion on the real cost of mining gold and silver. If investors believe it only costs $7-$10 to produce an ounce of silver, they will have less faith in a $20 silver price holding. To them, the market price of silver could fall to $10-$15, just as the analysts at Natixis stated in article linked above.

Of course, these Natixis analysts work for a French Global Financial company that makes excellent profits from the highly inflated fiat monetary system. So, it’s in the best interest for these institutions to keep investors believing that gold & silver are low price garbage assets not worthy of anyone’s time, while the real profits are made in the Grand Financial Ponzi Scheme.

Let’s compare the financial statements from Natixis and my top 12 primary silver miners:

Natixis Global Asset Management

2013 Total Revenues = $7.2 Billion (Euros)

2013 Net Income = $1.1 Billion (Euros)

2013 Net Income profit ratio = 15.2%

Top 12 Primary Silver Miners

2013 Total Revenues = $3.1 Billion (Estimated)

2013 Adjusted Income = -$20 million (Estimated)

2013 Adjusted Income profit ratio = -0.6%

Now, why on earth would anyone in the right mind be investing in physical silver or the mining companies when we can plainly see the GRAND FIAT CASINO makes the real profits?

To make matters even worse, the precious metals industry and analysts confuse investors by focusing on the insane low CASH COST METRIC. Whenever Thomson Reuters GFMS publishes a Silver Update, they show costs in this absurd CASH COST metric.

GFMS Cash Cost

Here we can see the industry is ADVERTISING a $7.5 CASH COST for silver, which means the miners are supposedly rolling in dough at a $17 an ounce profit margin in 2013. While sophisticated investors realize this isn’t a true cost, many new or inexperienced members of the precious metal community take these figures at face value.

This is really important to understand… which is why I am writing about it today. Actually, the inspiration to write this article came from comments made by several readers on my site.

I received many comments from my recent article, “Record Silver Eagle Buying As Industry Analysts Mislead The Pubic.” A reader disagreed with my opinion on Cash Costs by replying below:

Warren B says:

April 2, 2014 at 8:23 pm

“Cash Cost accounting is an insane outdated metric that provides no real clue as to the profitability of a company.” That statement is totally incompetent. Cash cost is the only relevant way to view the business.

From the beginning. Before anything happens, there’s a venture study that estimates capital and operating costs. That can be a new operation, expansion of a current one, new product line. If it looks favorable it’s a go but no significant resources are committed until there are enough customers signed up on long term contracts to cover fixed cost and ROI. Assuming that happens and everything moves forward, as soon as the start button is pushed, capital cost is sunk money and cash cost determines the future outcome. Low cost provider always wins over the long term. That’s the way the real world operates.

To say the business is driven by or even slightly affected by “provision for, adjustments to, changes in accounting methods, allocations, depreciation reserve, future tax incentives …” is total nonsense. These aren’t even considered in venture analysis nor analysis of current operations. And, you can’t meet the payroll with any of them.

Non-cash costs (leading to total cost) can be manipulated to any value with the push of a computer button. The clue is in the number of footnotes to the annual financial statements. It doesn’t take 343 footnotes to CYA on an honest, factual report. The rule of thumb is anything over 3, the books are cooked in proportion. How many do these mining companies have?

Another point. In your financial table, notice that the “by-product credit” is 10 times the silver. So actually silver is a small sideline business. Cash cost isn’t stated. Allocation method can make silver cost and profitability anything you want it to be. In practice, costs shuffle across individual product operating statements to maximize the “bonus metrics” set for the management. That’s in the operating set of books that you won’t ever see. For public documents, product lines are grouped in the reports so you can’t separate out what’s going on with any of them and can be manipulated to support whatever BS the management is pushing. That’s the way that works.

Warren regards my analysis on this matter as completely incompetent and that cash costs are ,“The only relevant way to view the business.” He then goes on to say that the companies have several books and that they can manipulate to support whatever BS the management is pushing.

I totally disagree with Warren, but before I discuss why… here is a comment by another reader who also takes the same side of the debate on this issue:

Melissa P says:

April 2, 2014 at 8:35 am

Contrary to one of the main points you raise …. from 1990 to 2005 silver did sell for $5-8/oz !! That means the full cost was below that level. $25/oz cost? No one is going to be operating at that kind of loss for 15 years. Right? Add Inflation from 2005 and you get to a current cost of $7-10/oz. The problem with your analysis is you’re using numbers that are manipulated for a host of reasons. And, apparently, you don’t know what they do or how they do it. I do. Forget about FASB and GAAP. Remember Enron? That bunch of crooks met all of those standards. So did the bankrupt, government bailed out banksters.

I’ll give you another prime example. Every feature movie produced by every studio in the last 50 years has lost $50 million or more. By their financial reporting, none has ever made a profit. Same with TV series. Yet, each studio cranks out 30-35 feature movies each year. How can they keep doing that? And, have an actual ROI over 30%. Have someone explain it to you and that’ll give you at least some insight into correcting your faulty analysis and conclusions.

“THERE ARE NO SILVER PRODUCERS THAT CAN AFFORD TO MINE SILVER ANYWHERE NEAR $10, much less $7″. Not to sound nasty, but you need to learn basic grammar. As written, that statement is nonsensical.

Melissa goes on and on about the same accounting fraud taking place in several different industries implying that the gold and silver miners are doing the same thing. Which means, they are supposedly EXTORTING huge profits while showing higher costs and less income on their books.

I replied to Melissa with this comment:

Melissa,

Yes, it’s true… I am a butcher when it comes to writing. I have stated that several times. Thanks for pointing out the obvious.

However, I believe my grasp on the mining cost structure is better than my writing ability. Let me explain. The reason the cost of silver remained low in the 1990′s to early 2000′s had everything to do with the price of oil. Oil was $25 a barrel in 2002 and is now $100-$110.

The price of oil fluctuated between $16-$23 a barrel from 1990-1999 which you can plainly see in the graph above. Which is why the cost of silver was in the $4-5 range. Furthermore, Hecla & Coeur suffered losses several years in that 1990-2002 time period.

If we look at the price of gold and silver, both quadrupled since 2002. The rise in the price of energy had EVERYTHING to do with it.

The price of energy thunders through the economy. Some have stated that labor wages are low in Mexico and South America where most of the silver is mined. However, rising energy prices forces companies to pay more for everything. And then we have the problem with the U.S. exporting inflation which kills the value of local currencies.

How do you get $7-10 cost an ounce inflation when the price of oil has quadrupled? Sorry, I have no clue about the movie or film industry. But when it comes to gold and silver mining… costs have quadrupled since 2002. It’s all due to the price of energy.

Warren and Melissa believe cash costs are a more relevant way to view the mining business as we really can’t believe the management from these companies because they are manipulating data by hiding it in several different account books.

Let me tell you, I get this same silly notion from many of my readers. For example, check out this comment:

Michael says:

March 31, 2014 at 2:02 pm

You’re making an incorrect assumption that energy = cost of production. The major component of primary production is labor and the major producing countries have wages below what old plantation slaves worked for. What large users pay for energy is not what you see in the “spot market” price, your utility bill or any report that you have access to. Electrolytic operations, like metal refiners, are using energy priced as low as $0.005/kwh. Did you know that? Remember government? And, energy is not just oil.

Like the Mafia, corporations have 3 sets of books. The first is “Operations”. That’s the real deal, top secret, restricted to top management. The second is “Shareholder”. Those are cooked to present the rosiest picture possible without revealing any truth about what’s really going on. That’s what you see. The third is “Tax”. Those are manipulated to avoid paying taxes. Examples. No oil company has ever made a tax basis profit since JDR started the Standard Oil monopoly over a century ago. Companies reporting record earnings declaring total bankruptcy within a month after the report. Remember Enron?

Here again, is another reader telling me that I am completely FOC – Full of Crap. Also, there is the mention again that the mining industry is like the Mafia who use 3 or more books to hide the truth that they are SKIMMING profits, while the public is bamboozled to believe costs are much higher.

I don’t mind at all readers disagreeing with me and presenting the other side of the debate. However, when I find out that SOMETHING FISHY THIS WAY BLOWS… then its time to bring out the BIG GUNS.

If you remember Melissa’s comment, she stated that I needed to work on my writing ability (which I do). Because she was so open and honest about that item, I thought it would be fair to RETURN THE FAVOR.

You see…. Warren, Melissa and Michael are ALL THE SAME INDIVIDUAL. That’s correct.

I am not going to get into the details why I know… but IT’S THE TRUTH. I manage my site which enables me to see whats going on behind the scenes. So, the real question is this. Why would an individual come in my website under several different screen names to try to persuade me or my readers that CASH COSTS are relevant and the mining companies’ financial reports shouldn’t be trusted?

Either this individual wants to make it seem as if there were several people shooting holes in my analysis, or it could be something a bit more sinister. We all know that blogs have members who are there to purposely misinform and confuse investors.

Some bloggers make comments this way because they believe it, while others enjoy frustrating investors for the pleasure of it. Unfortunately, there is a real threat of PAID BASHERS who do it for money. Now, I am not saying this is the case in this instance, but I find it strange that an individual would go to that length to try to confuse precious metal investors.

I say confuse… because the FACTS & DATA that I have found, paint a picture that costs and break-even in the gold and silver industry are much higher than the silly cash cost metric. According to my calculations, estimated break-even for my top 12 primary silver miners was $23-24 in 2013. And… I don’t believe that is a sustainable figure for the group.

My $23-24 figure differs greatly than the $7-$8 Cash Cost figure the industry, the companies and the banking analysts put out. I actually spoke with silver analyst, David Morgan on the phone yesterday about this very subject.

David believes the cash cost accounting figure was a deliberate way to confuse investors to the real costs of mining gold or silver…. I agree.

If we go to Hecla’s website and click on their INVESTORS PAGE, this is the chart we would see on record margins:

Again, the sophisticated precious metal investor would get a good laugh at this chart, however, the inexperienced newcomer in the market would actually believe silver costs are this low. As I have mentioned many times… I receive a lot of email from readers who actually believe silver production costs are in the $7-$10 range.

And it doesn’t help when you have professional nitwit analysts at Natixis stating the same thing.

Did Hecla really make a $14 an ounce cash margin profit in 2013? No of course not. They stated a $12.7 million Adjusted Net Loss for the year… and that was at an average realized price of $21.28 for 2013. Can you imagine the losses they would incur if the market price of silver was $7 or $10?

If we were to believe Warren, Melissa or Michael (all the same person)… Hecla would have several books hiding the fact that management is extorting $millions while the government, investors and the public are hoodwinked to believe costs are much higher.

PURE BOLLOCKS….

If you look at my chart above, you will notice that the cost to mine silver has increased in same fashion as the rise in the price of oil. The price of a barrel of oil was $25 in 2002 and in 2013 it quadrupled to $108.

However, the mining industry doesn’t buy barrels of oil, rather they consume diesel. Let’s look at the price change in diesel:

1998 Diesel price gallon = $1.04 (U.S.)

2002 Diesel price gallon = $1.31 (U.S.)

2013 Diesel price gallon = $3.92 (U.S.)

Here we can see that diesel spot prices have tripled from 2002-2013 and nearly quadrupled from 1998-2013. As the price of energy increases, it pushes up prices of materials, goods and services substantially on the mining companies’ balance sheets.

And this is only part of the story. The chart below reveals the DOUBLE-WHAMMY:

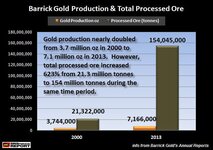

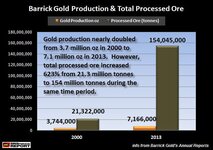

In 2000, Barrick processed 21.3 million tonnes of ore to produce 3.74 million ounces of gold. By 2013, they nearly doubled production to 7.16 million oz, however the amount of processed ore increased a staggering 623%.

Not only have overall input costs skyrocketed since 2000, but the amount of materials and goods consumed per ounce of gold produced increased as ore grades declined. In 2000, Barrick produced gold at 5.47 grams per tonne and by 2013, the average yield declined to a paltry 1.43 grams per tonne.

So, when we add it all up together, a quadrupling of energy costs and increased consumption of materials and goods with higher wages and CAPEX spending… costs in the silver and gold industry are at least four times higher than they were in 2000.

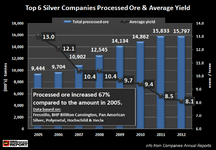

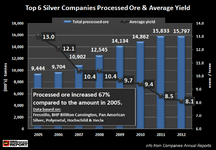

The gold miners aren’t the only ones suffering from declining ore grades, it’s happening throughout the entire industry. The top primary silver mining industry’s average yield declined from 13 ounces per ton in 2005, to 8.1 oz/tonne in 2012.

The notion that it takes $7-$10 to produce an ounce of silver today is totally ridiculous when we go by common sense logic and broad-based analysis.

Unfortunately, this is the problem with the market today. Instead of making the system simpler for investors to understand, the industry purposely complicates things to keep the public in the dark. This same tactic that takes place in many industries.

The person who goes by three different screen names (for some strange reason), wants investors to know that cash costs are a realistic metric for determining the cost in producing silver. They go on to say that capital costs are SUNK money and cash costs determines the future outcome of the company.

My reply to that is…. IF YOU EXCLUDE ENOUGH COSTS… YOU CAN MAKE ANYTHING LOOK PROFITABLE.

That’s actually a term I stole from energy analyst Art Berman describing the Shale Gas Industry in a recent presentation.

Individuals invested hard-earned fiat currency in the CAPEX to get a mine to commercial production as well as the annual capital spending to maintain the project. If the business practice in the mining industry is to raise CAPEX by issuing millions of shares to build new mines, but to EXCLUDE this when factoring the cost of mining silver… it’s the SHAREHOLDER who becomes the BAG-HOLDER.

I find that reasoning appalling. No wonder shareholders are skeptical of the mining industry.

Michael, Melissa and Warren want us to believe the mining industry is pulling the WOOL over the eyes of the investing public. This is just another tactic to confuse investors.

Precious metal investors need to understand that it is extremely expensive to produce gold and silver. While the industry, analysts and the companies make it difficult to understand the true cost of mining these metals, I have no respect for CHARLATANS who add to this problem.

In conclusion…. the current prices of gold and silver are near the break-even level for the mining industry. I believe this level puts a floor in their prices even though paper trading can induce lower spikes.

A base price for gold and silver from a cost perspective is only one part of the story. The real fun happens when the public finally realizes it is the BAG-HOLDER in the biggest Ponzi scheme in history.

At that point, the prices of gold and silver will rise to levels several times above their cost of production. This is the event we precious metals investors patiently wait for.

Please check back at the SRSrocco Report for updates and new articles and you can follow us a Twitter:

Filed in Mining, Precious Metals by SRSrocco on April 3, 2014

Many precious metals investors are being deceived and they don’t even know it. There is so much fraud, manipulation and deceit taking place in the economic and financial markets, its amazing the system hasn’t collapsed already.

However, there is another big problem taking place in the precious metal industry that has frustrated me to no end. This is what I call the “Grand Deception.”

Let me explain…

The market sentiment in the precious metals is at an all-time low. Banks and brokerage houses are now coming out with the typical “Gold’s going to $1,000 or below forecasts.” Then we had this GEM from the wonderful folks at Natixis, “$10/oz Silver in 2015 Among Natixis Scenarios.”

$10/oz silver in 2015 among Natixis scenarios - GOLD NEWS - Mineweb.com Mineweb

With the current low price of gold and silver, including all the negative press coming from MSM, many precious metals investors are increasingly frustrated and concerned about their metal investments.

One of the major problems as I see it, is the confusion on the real cost of mining gold and silver. If investors believe it only costs $7-$10 to produce an ounce of silver, they will have less faith in a $20 silver price holding. To them, the market price of silver could fall to $10-$15, just as the analysts at Natixis stated in article linked above.

Of course, these Natixis analysts work for a French Global Financial company that makes excellent profits from the highly inflated fiat monetary system. So, it’s in the best interest for these institutions to keep investors believing that gold & silver are low price garbage assets not worthy of anyone’s time, while the real profits are made in the Grand Financial Ponzi Scheme.

Let’s compare the financial statements from Natixis and my top 12 primary silver miners:

Natixis Global Asset Management

2013 Total Revenues = $7.2 Billion (Euros)

2013 Net Income = $1.1 Billion (Euros)

2013 Net Income profit ratio = 15.2%

Top 12 Primary Silver Miners

2013 Total Revenues = $3.1 Billion (Estimated)

2013 Adjusted Income = -$20 million (Estimated)

2013 Adjusted Income profit ratio = -0.6%

Now, why on earth would anyone in the right mind be investing in physical silver or the mining companies when we can plainly see the GRAND FIAT CASINO makes the real profits?

To make matters even worse, the precious metals industry and analysts confuse investors by focusing on the insane low CASH COST METRIC. Whenever Thomson Reuters GFMS publishes a Silver Update, they show costs in this absurd CASH COST metric.

GFMS Cash Cost

Here we can see the industry is ADVERTISING a $7.5 CASH COST for silver, which means the miners are supposedly rolling in dough at a $17 an ounce profit margin in 2013. While sophisticated investors realize this isn’t a true cost, many new or inexperienced members of the precious metal community take these figures at face value.

This is really important to understand… which is why I am writing about it today. Actually, the inspiration to write this article came from comments made by several readers on my site.

I received many comments from my recent article, “Record Silver Eagle Buying As Industry Analysts Mislead The Pubic.” A reader disagreed with my opinion on Cash Costs by replying below:

Warren B says:

April 2, 2014 at 8:23 pm

“Cash Cost accounting is an insane outdated metric that provides no real clue as to the profitability of a company.” That statement is totally incompetent. Cash cost is the only relevant way to view the business.

From the beginning. Before anything happens, there’s a venture study that estimates capital and operating costs. That can be a new operation, expansion of a current one, new product line. If it looks favorable it’s a go but no significant resources are committed until there are enough customers signed up on long term contracts to cover fixed cost and ROI. Assuming that happens and everything moves forward, as soon as the start button is pushed, capital cost is sunk money and cash cost determines the future outcome. Low cost provider always wins over the long term. That’s the way the real world operates.

To say the business is driven by or even slightly affected by “provision for, adjustments to, changes in accounting methods, allocations, depreciation reserve, future tax incentives …” is total nonsense. These aren’t even considered in venture analysis nor analysis of current operations. And, you can’t meet the payroll with any of them.

Non-cash costs (leading to total cost) can be manipulated to any value with the push of a computer button. The clue is in the number of footnotes to the annual financial statements. It doesn’t take 343 footnotes to CYA on an honest, factual report. The rule of thumb is anything over 3, the books are cooked in proportion. How many do these mining companies have?

Another point. In your financial table, notice that the “by-product credit” is 10 times the silver. So actually silver is a small sideline business. Cash cost isn’t stated. Allocation method can make silver cost and profitability anything you want it to be. In practice, costs shuffle across individual product operating statements to maximize the “bonus metrics” set for the management. That’s in the operating set of books that you won’t ever see. For public documents, product lines are grouped in the reports so you can’t separate out what’s going on with any of them and can be manipulated to support whatever BS the management is pushing. That’s the way that works.

Warren regards my analysis on this matter as completely incompetent and that cash costs are ,“The only relevant way to view the business.” He then goes on to say that the companies have several books and that they can manipulate to support whatever BS the management is pushing.

I totally disagree with Warren, but before I discuss why… here is a comment by another reader who also takes the same side of the debate on this issue:

Melissa P says:

April 2, 2014 at 8:35 am

Contrary to one of the main points you raise …. from 1990 to 2005 silver did sell for $5-8/oz !! That means the full cost was below that level. $25/oz cost? No one is going to be operating at that kind of loss for 15 years. Right? Add Inflation from 2005 and you get to a current cost of $7-10/oz. The problem with your analysis is you’re using numbers that are manipulated for a host of reasons. And, apparently, you don’t know what they do or how they do it. I do. Forget about FASB and GAAP. Remember Enron? That bunch of crooks met all of those standards. So did the bankrupt, government bailed out banksters.

I’ll give you another prime example. Every feature movie produced by every studio in the last 50 years has lost $50 million or more. By their financial reporting, none has ever made a profit. Same with TV series. Yet, each studio cranks out 30-35 feature movies each year. How can they keep doing that? And, have an actual ROI over 30%. Have someone explain it to you and that’ll give you at least some insight into correcting your faulty analysis and conclusions.

“THERE ARE NO SILVER PRODUCERS THAT CAN AFFORD TO MINE SILVER ANYWHERE NEAR $10, much less $7″. Not to sound nasty, but you need to learn basic grammar. As written, that statement is nonsensical.

Melissa goes on and on about the same accounting fraud taking place in several different industries implying that the gold and silver miners are doing the same thing. Which means, they are supposedly EXTORTING huge profits while showing higher costs and less income on their books.

I replied to Melissa with this comment:

Melissa,

Yes, it’s true… I am a butcher when it comes to writing. I have stated that several times. Thanks for pointing out the obvious.

However, I believe my grasp on the mining cost structure is better than my writing ability. Let me explain. The reason the cost of silver remained low in the 1990′s to early 2000′s had everything to do with the price of oil. Oil was $25 a barrel in 2002 and is now $100-$110.

The price of oil fluctuated between $16-$23 a barrel from 1990-1999 which you can plainly see in the graph above. Which is why the cost of silver was in the $4-5 range. Furthermore, Hecla & Coeur suffered losses several years in that 1990-2002 time period.

If we look at the price of gold and silver, both quadrupled since 2002. The rise in the price of energy had EVERYTHING to do with it.

The price of energy thunders through the economy. Some have stated that labor wages are low in Mexico and South America where most of the silver is mined. However, rising energy prices forces companies to pay more for everything. And then we have the problem with the U.S. exporting inflation which kills the value of local currencies.

How do you get $7-10 cost an ounce inflation when the price of oil has quadrupled? Sorry, I have no clue about the movie or film industry. But when it comes to gold and silver mining… costs have quadrupled since 2002. It’s all due to the price of energy.

Warren and Melissa believe cash costs are a more relevant way to view the mining business as we really can’t believe the management from these companies because they are manipulating data by hiding it in several different account books.

Let me tell you, I get this same silly notion from many of my readers. For example, check out this comment:

Michael says:

March 31, 2014 at 2:02 pm

You’re making an incorrect assumption that energy = cost of production. The major component of primary production is labor and the major producing countries have wages below what old plantation slaves worked for. What large users pay for energy is not what you see in the “spot market” price, your utility bill or any report that you have access to. Electrolytic operations, like metal refiners, are using energy priced as low as $0.005/kwh. Did you know that? Remember government? And, energy is not just oil.

Like the Mafia, corporations have 3 sets of books. The first is “Operations”. That’s the real deal, top secret, restricted to top management. The second is “Shareholder”. Those are cooked to present the rosiest picture possible without revealing any truth about what’s really going on. That’s what you see. The third is “Tax”. Those are manipulated to avoid paying taxes. Examples. No oil company has ever made a tax basis profit since JDR started the Standard Oil monopoly over a century ago. Companies reporting record earnings declaring total bankruptcy within a month after the report. Remember Enron?

Here again, is another reader telling me that I am completely FOC – Full of Crap. Also, there is the mention again that the mining industry is like the Mafia who use 3 or more books to hide the truth that they are SKIMMING profits, while the public is bamboozled to believe costs are much higher.

I don’t mind at all readers disagreeing with me and presenting the other side of the debate. However, when I find out that SOMETHING FISHY THIS WAY BLOWS… then its time to bring out the BIG GUNS.

If you remember Melissa’s comment, she stated that I needed to work on my writing ability (which I do). Because she was so open and honest about that item, I thought it would be fair to RETURN THE FAVOR.

You see…. Warren, Melissa and Michael are ALL THE SAME INDIVIDUAL. That’s correct.

I am not going to get into the details why I know… but IT’S THE TRUTH. I manage my site which enables me to see whats going on behind the scenes. So, the real question is this. Why would an individual come in my website under several different screen names to try to persuade me or my readers that CASH COSTS are relevant and the mining companies’ financial reports shouldn’t be trusted?

Either this individual wants to make it seem as if there were several people shooting holes in my analysis, or it could be something a bit more sinister. We all know that blogs have members who are there to purposely misinform and confuse investors.

Some bloggers make comments this way because they believe it, while others enjoy frustrating investors for the pleasure of it. Unfortunately, there is a real threat of PAID BASHERS who do it for money. Now, I am not saying this is the case in this instance, but I find it strange that an individual would go to that length to try to confuse precious metal investors.

I say confuse… because the FACTS & DATA that I have found, paint a picture that costs and break-even in the gold and silver industry are much higher than the silly cash cost metric. According to my calculations, estimated break-even for my top 12 primary silver miners was $23-24 in 2013. And… I don’t believe that is a sustainable figure for the group.

My $23-24 figure differs greatly than the $7-$8 Cash Cost figure the industry, the companies and the banking analysts put out. I actually spoke with silver analyst, David Morgan on the phone yesterday about this very subject.

David believes the cash cost accounting figure was a deliberate way to confuse investors to the real costs of mining gold or silver…. I agree.

If we go to Hecla’s website and click on their INVESTORS PAGE, this is the chart we would see on record margins:

Again, the sophisticated precious metal investor would get a good laugh at this chart, however, the inexperienced newcomer in the market would actually believe silver costs are this low. As I have mentioned many times… I receive a lot of email from readers who actually believe silver production costs are in the $7-$10 range.

And it doesn’t help when you have professional nitwit analysts at Natixis stating the same thing.

Did Hecla really make a $14 an ounce cash margin profit in 2013? No of course not. They stated a $12.7 million Adjusted Net Loss for the year… and that was at an average realized price of $21.28 for 2013. Can you imagine the losses they would incur if the market price of silver was $7 or $10?

If we were to believe Warren, Melissa or Michael (all the same person)… Hecla would have several books hiding the fact that management is extorting $millions while the government, investors and the public are hoodwinked to believe costs are much higher.

PURE BOLLOCKS….

If you look at my chart above, you will notice that the cost to mine silver has increased in same fashion as the rise in the price of oil. The price of a barrel of oil was $25 in 2002 and in 2013 it quadrupled to $108.

However, the mining industry doesn’t buy barrels of oil, rather they consume diesel. Let’s look at the price change in diesel:

1998 Diesel price gallon = $1.04 (U.S.)

2002 Diesel price gallon = $1.31 (U.S.)

2013 Diesel price gallon = $3.92 (U.S.)

Here we can see that diesel spot prices have tripled from 2002-2013 and nearly quadrupled from 1998-2013. As the price of energy increases, it pushes up prices of materials, goods and services substantially on the mining companies’ balance sheets.

And this is only part of the story. The chart below reveals the DOUBLE-WHAMMY:

In 2000, Barrick processed 21.3 million tonnes of ore to produce 3.74 million ounces of gold. By 2013, they nearly doubled production to 7.16 million oz, however the amount of processed ore increased a staggering 623%.

Not only have overall input costs skyrocketed since 2000, but the amount of materials and goods consumed per ounce of gold produced increased as ore grades declined. In 2000, Barrick produced gold at 5.47 grams per tonne and by 2013, the average yield declined to a paltry 1.43 grams per tonne.

So, when we add it all up together, a quadrupling of energy costs and increased consumption of materials and goods with higher wages and CAPEX spending… costs in the silver and gold industry are at least four times higher than they were in 2000.

The gold miners aren’t the only ones suffering from declining ore grades, it’s happening throughout the entire industry. The top primary silver mining industry’s average yield declined from 13 ounces per ton in 2005, to 8.1 oz/tonne in 2012.

The notion that it takes $7-$10 to produce an ounce of silver today is totally ridiculous when we go by common sense logic and broad-based analysis.

Unfortunately, this is the problem with the market today. Instead of making the system simpler for investors to understand, the industry purposely complicates things to keep the public in the dark. This same tactic that takes place in many industries.

The person who goes by three different screen names (for some strange reason), wants investors to know that cash costs are a realistic metric for determining the cost in producing silver. They go on to say that capital costs are SUNK money and cash costs determines the future outcome of the company.

My reply to that is…. IF YOU EXCLUDE ENOUGH COSTS… YOU CAN MAKE ANYTHING LOOK PROFITABLE.

That’s actually a term I stole from energy analyst Art Berman describing the Shale Gas Industry in a recent presentation.

Individuals invested hard-earned fiat currency in the CAPEX to get a mine to commercial production as well as the annual capital spending to maintain the project. If the business practice in the mining industry is to raise CAPEX by issuing millions of shares to build new mines, but to EXCLUDE this when factoring the cost of mining silver… it’s the SHAREHOLDER who becomes the BAG-HOLDER.

I find that reasoning appalling. No wonder shareholders are skeptical of the mining industry.

Michael, Melissa and Warren want us to believe the mining industry is pulling the WOOL over the eyes of the investing public. This is just another tactic to confuse investors.

Precious metal investors need to understand that it is extremely expensive to produce gold and silver. While the industry, analysts and the companies make it difficult to understand the true cost of mining these metals, I have no respect for CHARLATANS who add to this problem.

In conclusion…. the current prices of gold and silver are near the break-even level for the mining industry. I believe this level puts a floor in their prices even though paper trading can induce lower spikes.

A base price for gold and silver from a cost perspective is only one part of the story. The real fun happens when the public finally realizes it is the BAG-HOLDER in the biggest Ponzi scheme in history.

At that point, the prices of gold and silver will rise to levels several times above their cost of production. This is the event we precious metals investors patiently wait for.

Please check back at the SRSrocco Report for updates and new articles and you can follow us a Twitter: