West Jersey Detecting

Gold Member

From Today's Wall Street Journal:

INVESTINGNOVEMBER 19, 2009

The Million-Dollar Penny

Investors Drive Up Prices of High-End Collectibles as Less-Rarefied Items Languish

By JEFF D. OPDYKE

When is a penny worth a million dollars?

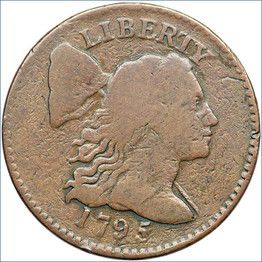

When it's a 1795 reeded-edge U.S. penny, one of only seven known to exist. It recently sold for nearly $1.3 million at auction—the first time a one-cent coin has cracked the million-dollar price barrier.

It follows the sale earlier this year of a high-end collection of rare half-dollars that fetched $1.1 million at auction. At the same time, popular $20 U.S. Saint-Gaudens gold pieces from the early 20th century are commanding $1,700 apiece, sight unseen, in decent, though not perfect condition, topping a record high last seen more than two decades ago.

Credits: Goldberg Coins

$1.3 million: 1795 reeded-edge U.S. penny

Today's coin market is largely defined by high-end investors grabbing the rarest of coins that infrequently come up for sale; gold bugs snapping up gold coins; and speculators bidding up prices for coins whose grades they suspect are too low, in the hopes of securing a higher grade and selling them for more money. Yet ordinary collectible coins—the nickels, dimes and quarters that are nice but not great—have fallen in value by as much as 30% over the past year, say coin dealers and auction-house executives.

"It's easier to sell a $100,000 coin today than a $1,000 coin," says John Albanese, founder of Certified Acceptance Corp., based in Bedminster, N.J., which verifies graded coins.

That mirrors the trend in other collectible markets, such as those for fine art, wine and jewelry. The high end of these markets is garnering big interest as investors increasingly worry about the weakening dollar and the potential for future inflation. Yet lower-end collectibles are struggling in the aftermath of the financial crisis. The Liv-Ex 100 index of investment-grade wine in October was down about 11% since peaking just before the economic downturn. An index of contemporary art is off almost 50% in the 12 moths ended in September, according to Artnet.com, an art information and services Web site.

"Anything that is commercial or easily replaceable isn't selling so well right now," says Rahul Kadakia, head of the jewelry department at New York auction house Christie's. "But if you have something great, there is still a very big market for it, and there are buyers who want to spend to get those great things."

At an October Christie's auction, the 32-carat white Annenberg Diamond sold for $7.7 million, or more than $240,000 per carat, shattering world-record prices for white diamonds. Last week, Andy Warhol's 1962 silkscreen painting "200 One Dollar Bills" sold for $43.7 million to an anonymous buyer at a Sotheby's auction in New York—more than three times its high estimate of $12 million. Auctions this fall have established new price records for a host of fine-art photographers. And blue-chip wines such as Bordeaux from Chateau Lafitte, Petrus, Le Pin and Ausone "are on fire," says Charles Curtis, head of Christie's North American wine sales.

Sales of gold coins are up as much as 75% at Dallas-based online auction house Heritage Auctions Inc. "because there is just so much demand," says Jim Halperin, the auction house's co-chairman. "Even Warren Buffett is talking about inflation these days, and people I talk to who are buying coins are worried about a massive onslaught. They're buying coins because they want to hold something tangible that will do well."

Coins are generally graded on a scale of 1 (lowest) to 70 (highest), with mint-grade coins—those showing no signs of being circulated—starting at grade 60. Numismatic Guaranty Corp., based in Sarasota, Fla., one of the two main coin-grading services, has recently opened offices in Asia and Europe, as foreigners exploit the weak dollar to grab rare, antique coins that have long resided in the U.S. Demand for grading services has surged to such a degree that the company's 20 graders are handing as many as 12,000 coins a day, double the level just after the financial crisis hit last year.

Behind the trend are collectors like Robert Beckwitt, a 51-year-old New York money manager. He renewed his childhood fascination with collectible coins a decade ago because coins were cheap. Today, his interest in high-grade coins reflects an investor's mindset.

"This is my way of diversifying away from stocks and bonds and the U.S. dollar," he says. In recent years Mr. Beckwitt has snapped up some of the finest examples of coins available, such as the highest-graded 1796 quarter, the first ever minted. Over the summer he grabbed for an undisclosed sum the finest-known 1797 half-dollar. "It wasn't cheap," he says. "But I love the history of these early coins."

Before the economic crisis, the coin market was defined by rapidly rising prices for all manner of coins and widespread demand from seasoned collectors, casual hobbyists and investors. Now, casual hobbyists and low-end collectors are largely sitting on the sidelines, victims of the economy.

The coins at the focus of today's activity have generally held their value or are rising, either because of their gold value or because of their rarity. A September auction of rare, large U.S. pennies from the late 18th century established world-record prices for one-cent coins, among them the penny that sold for nearly $1.3 million, including commissions—well in excess of presale estimates of about $250,000, says Ira Goldberg, co-owner of Beverly Hills,Calif -based Goldberg Coins & Collectibles, which ran the auction.

One reason high-end coins are holding up is because wealthier collectors are competing to build "set registries"—the best-possible collection of a particular coin—that they display online. When a high-graded coin comes to market, "the high-end guys are fighting over it to improve their collection or get bragging rights," says Shane Downing, publisher of the Certified Coin Dealer Newsletter, a widely followed source of coin pricing.

Many collectors also see high-end coins as a viable asset class at a time when they're dismayed by stocks, bonds and other investments amid worries about the economy and the long-term direction of the dollar. Historically, high-end coins have fared well as an asset. The PCGS3000 Index of rare coins has returned an annualized 11.3% since January 1970. During that same period, the Dow Jones Industrial Average has gained about 6.5% annually.

Earlier this year, Dale Friend, a retired lawyer in Lake Tahoe, Nev., auctioned a complete collection of so-called U.S. Barber half-dollars, minted between 1892 and 1915. The high-grade collection took seven years to build, and Mr. Friend held the set for eight years thereafter. His coins earned $1.1 million at auction, nearly 100% more than their original cost.

"Though I think of myself as a collector, I'm really an investor," says the 68-year-old Mr. Friend. "I've realized I have very little control over investments in stocks and real estate. But with coins I can know all there is to know about the investment I'm going to make." He has recently started building a collection of U.S. Capped Bust half-dollars from the early 19th century.

Many coin buyers these days are hoping for a quicker score through the "crack out" strategy. They're buying high-quality graded coins and cracking them out of their hard plastic casings in order to resubmit to them to a grading service for a higher grade. They choose coins, in part, based on how they look compared to similar coins of the same grade. Many times they're right, and the coins are ultimately awarded a higher grade.

Though there are huge risks with this strategy—including the potential that a coin is downgraded or loses its grade altogether—a successful regrading "can add thousands of dollars to a coin's value," says Scott Travers, a New York coin dealer and author of numerous coin guides. One example: A $20 U.S. Saint-Gaudens gold coin currently fetches a few hundred dollars over bullion prices in "mint-state 63." A one-grade increase would push the value to more than $3,000, according to the Certified Coin Dealer Newsletter. A two-grade improvement would increase the value to about $17,000.

"I'm getting calls several times an hour from people who want to play the crack-out game," Mr. Travers says. "If you're really careful about what you're buying, there's tremendous upside and little downside."

Write to Jeff D. Opdyke at [email protected]