dreamboxvip

Full Member

- May 1, 2014

- 218

- 110

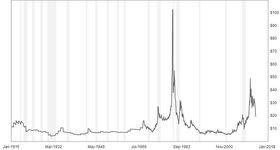

Silver going backwards once again. Will it ever recover?

Amazon Forum Fav 👍

Upvote

0

Silver going backwards once again. Will it ever recover?

I pretty much think it peaked for at least this decade...I remember when it was in the 40/oz range...I was holding out and telling myself, "When it hits 50/oz..Im selling it ALL"...so i watched it hit 49 dollars..then it hit 49.75 Then within a week or 2, I watched it drop to 30...then 25...then 20. Of course I would have loved to cash in , but thats just how it works. Silver is always going to be needed and wanted. Just because its dropping now, doesnt mean anything to me. Just like stocks and Real Estate. It ALWAYS bounces back. I would just take advantage of it being low to buy right now

Silver going backwards once again. Will it ever recover?

Actually silver is nothing like stocks or real estate, which trend upward over time. PMs are all over the place and are completely unpredictable. People who hold most of their assets in PMs are better off opening a money market account. While it won't outpace inflation, at least it's going up in value.

I believe we will see decades of stagflation, no growth in PM's, and higher taxes.

I believe we will see decades of stagflation, no growth in PM's, and higher taxes.

If we see decades of a stagnant economy coupled with high inflation (which is entirely possible in my opinion), people will be driven in droves to PMs to protect the value of the wealth that they have from the inflation. Higher demand, higher price.

Silver down yet again

Silver down yet again

Glad I sold all my silver when I did. You conspiracy theorists who think the world is going to end and that silver and gold will be the only remaining currency are not going to be able to retire unless you can make at least 8-10% in a retirement savings vehicle (ie mutual funds). The DOW is 17,500 today, and will be 25k in no time, then 50k, and I will have millions while your Silver & Gold will be back to $5/oz & $200/oz like they were when I graduated HS. Don't risk your future - diversify your $ in something with a proven track record!