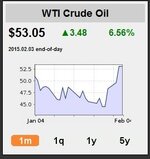

The price of oil rallied on Monday as investors speculated that the falling cost of crude may have ended.

Brent crude was up 1.3% at $53.65 a barrel, having reached $55, while US oil rose 1.7% to $48.52.

It followed the release of data showing that US demand for leasing oil rigs was slowing, suggesting that producers might be preparing to cut output.

Meanwhile, US giant ExxonMobil reported a 21% fall in quarterly earnings on lower oil and gas production.

Buying opportunity On Friday, data showed that more than 90 US oil rigs were idled, the largest number to be wound down in a single day since the mid-1980s.

[an error occurred while processing this directive] "There were a lot of people on the sidelines waiting for an opportunity to buy," said Bjarne Schieldrop, chief commodity analyst at SEB.

BBC News - Oil prices rebound on signs of output cuts