You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ouch! Silver takes another hit...

- Thread starter mts

- Start date

crazyjarhead

Gold Member

- Joined

- Sep 10, 2007

- Messages

- 10,318

- Reaction score

- 44

- Golden Thread

- 0

- Location

- N. San Diego County

- Detector(s) used

- Ace 250

- Primary Interest:

- Metal Detecting

Just like the stock market............up and down. Supply and demand run everything

Dave44

Silver Member

- Joined

- Apr 3, 2006

- Messages

- 4,815

- Reaction score

- 2,212

- Golden Thread

- 0

- Location

- Chesterfield, Va.

- Detector(s) used

- Whites XLT, Minelab Etrac, Minelab Excal II, At pro

- Primary Interest:

- All Treasure Hunting

As the crazyjarhead said,, buy on dips. I think he said? It is weird how it has been acting at close to 30. Like there is pressure from something.

mts

Bronze Member

- #4

Thread Owner

Dave44 said:As the crazyjarhead said,, buy on dips. I think he said? It is weird how it has been acting at close to 30. Like there is pressure from something.

Good advice. Except.... I recently bought on a "dip" and now it's dipped again.

The key is in waiting for the lowest of the dips before buying. And I'm absolutely terrible at waiting. I haven't pegged one yet. But I'm fairly sure it will eventually go back up. How long will I have to wait though? One day, one week, one year? How much lower will it go?

The key is in waiting for the lowest of the dips before buying. And I'm absolutely terrible at waiting. I haven't pegged one yet. But I'm fairly sure it will eventually go back up. How long will I have to wait though? One day, one week, one year? How much lower will it go?jim4silver

Silver Member

mts said:Dave44 said:As the crazyjarhead said,, buy on dips. I think he said? It is weird how it has been acting at close to 30. Like there is pressure from something.

Good advice. Except.... I recently bought on a "dip" and now it's dipped again.The key is in waiting for the lowest of the dips before buying. And I'm absolutely terrible at waiting. I haven't pegged one yet. But I'm fairly sure it will eventually go back up. How long will I have to wait though? One day, one week, one year? How much lower will it go?

I have not purchased silver since the very low 20s. If it gets back to 22-24, I will start dollar cost averaging on each "dip" and will cease new gold purchases, which is what I am buying now by dollar cost averaging.

I don't know how low silver will go on this "correction", but I believe if we ever see a big hit in the stock market like we did in 2008, the big institutions and hedge funds, etc, will liquidate a lot of their PM positions to offset their losses in stocks. If that were to happen I think we would easily get below 20 at least for a bit. I would imagine the premiums on physical would go higher in that it might be hard for coin stores to stock much inventory at those prices if it were a very sudden dip in price. If the price fall is somewhat gradual it won't be a problem, but if the price keeps falling at levels of 1 dollar a day, etc, supplies will tighten up until the price stabilizes at the lower prices for a while (if it were to do that). In that instance people will eventually start selling their PMs to the coin dealers and their inventories would go back up.

That is how it happened when it fell from 21 to 9 in 2008. All I could find when silver was 9 were happy birthday and merry Christmas bars type bars .999 (normally considered bottom of the barrel) for 2.50 over spot. Junk silver was even higher than that a bit. Wish I would have loaded up on those merry Christmas bars back then.

Some of the pundits who were around in the early 80s trading say that in a bull market like this there is always a pretty decent correction before the "blow off" top, when the prices of the commodity/PMs shoot up in a parabolic manner. This is when one really needs to think about selling at least some of their holdings (if there is a parabolic lift off that takes place). I think though even if it were to take off, it may stay up longer than before in the 80s since the dollar and debt issues, etc, are far worse now than back then.

Jim

I Won't buy till it hits $5.00

Then I'll but 10OZ. bars as often as I Can afford

Then I'll but 10OZ. bars as often as I Can afford

jim4silver

Silver Member

jeff of pa said:I Won't buy till it hits $5.00

Then I'll but 10OZ. bars as often as I Can afford

I like 10 oz bars too. If silver ever makes it to 5 bucks I think the bull market will clearly be over at that time. I wish I was into buying silver back when it was 5 bucks in the past.

Jim

mts

Bronze Member

- #8

Thread Owner

jim4silver said:mts said:Dave44 said:As the crazyjarhead said,, buy on dips. I think he said? It is weird how it has been acting at close to 30. Like there is pressure from something.

Good advice. Except.... I recently bought on a "dip" and now it's dipped again.The key is in waiting for the lowest of the dips before buying. And I'm absolutely terrible at waiting. I haven't pegged one yet. But I'm fairly sure it will eventually go back up. How long will I have to wait though? One day, one week, one year? How much lower will it go?

I have not purchased silver since the very low 20s. If it gets back to 22-24, I will start dollar cost averaging on each "dip" and will cease new gold purchases, which is what I am buying now by dollar cost averaging.

I don't know how low silver will go on this "correction", but I believe if we ever see a big hit in the stock market like we did in 2008, the big institutions and hedge funds, etc, will liquidate a lot of their PM positions to offset their losses in stocks. If that were to happen I think we would easily get below 20 at least for a bit. I would imagine the premiums on physical would go higher in that it might be hard for coin stores to stock much inventory at those prices if it were a very sudden dip in price. If the price fall is somewhat gradual it won't be a problem, but if the price keeps falling at levels of 1 dollar a day, etc, supplies will tighten up until the price stabilizes at the lower prices for a while (if it were to do that). In that instance people will eventually start selling their PMs to the coin dealers and their inventories would go back up.

That is how it happened when it fell from 21 to 9 in 2008. All I could find when silver was 9 were happy birthday and merry Christmas bars type bars .999 (normally considered bottom of the barrel) for 2.50 over spot. Junk silver was even higher than that a bit. Wish I would have loaded up on those merry Christmas bars back then.

Some of the pundits who were around in the early 80s trading say that in a bull market like this there is always a pretty decent correction before the "blow off" top, when the prices of the commodity/PMs shoot up in a parabolic manner. This is when one really needs to think about selling at least some of their holdings (if there is a parabolic lift off that takes place). I think though even if it were to take off, it may stay up longer than before in the 80s since the dollar and debt issues, etc, are far worse now than back then.

Jim

Good stuff as usual Jim. My problem will be holding off until it gets to $22-24. I get anxious that I'm going to miss out on the lowest dip for the rest of eternity and jump in with both feet. I haven't made a purchase of physical silver since the $18's so I'm doing well. But if it drops down to $25 I will be very tempted.

I sure wish I'd known about investing in silver back when it was $8 an ounce. But hindsight is always 20/20. In 5 years I may be kicking myself for not buying physical silver when it was "cheap" at $30! That's what happened last year with Gold. I could have bought gold at $1000 but expected it to come crashing back down to reality soon. That still hasn't happened and I'm still kicking myself.

I am still bullish long term on silver. But I wouldn't be surprised to see low $20's again soon. If it happens I'll buy around $10k more in physical silver. I may even buy one of those monster boxes.

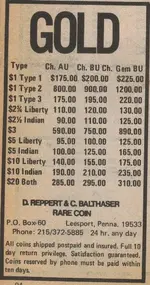

mts said:jeff of pa said:A Blast from 1978 / 1979

Wow! Pretty cool. What I find even more interesting than the silver and gold prices are the prices of rolls of common indian head cents, barbers, and other coins.

Yes These were actually Overpriced I Believe

- Joined

- Oct 6, 2009

- Messages

- 1,212

- Reaction score

- 2

- Golden Thread

- 0

- Location

- Florida- Somewhere in the middle

- Detector(s) used

- MXT 300/Excal II/Surf Dual Field

- Primary Interest:

- All Treasure Hunting

I also winced at the price of silver today since I "jumped in" when my cost was $29.90 oz.... BUT... I try not to pay too much attention to the spot market dips. The bars I bought are still selling for $34-35 oz for the guy selling 10 x 1oz lots.. His last auction of 10 bars ended at almost $370.. Thank God for the dummies who buy on ebay... LOL..

TheRandyMan

Hero Member

- Joined

- Apr 3, 2010

- Messages

- 576

- Reaction score

- 16

- Golden Thread

- 0

- Location

- Dallas, Texas

- Detector(s) used

- Excalibur II, Minelab Etrac, Ace 250k, Discovery TF-900

- Primary Interest:

- All Treasure Hunting

Anyone here heard of "Quantatative Easing"? Might be worth reading about a bit if you have not. A quick definition would be "Planned devaluation of the dollar bill by the Federal Reserve". Basically, they are flooding the world with dollars to devalue the dollar and make all our creditor's treasury note holdings (i.e. China and its 1.4 trillion dollars of our debt it holds currently) worth less and less. A direct effect of this will be the loss of our status as the Reserve Currency of the world. The poor fiscal responsibility of the last few years, combined with Quantatative Easing, has convinced most of the other nations that our time is up as the reserve currency. This will have drastic effects on the standard of living here in the United States.

Ever wonder why our gas is 3-4 dollars a gallon and everyone else in the world pays 6-7 dollars a gallon?

The reason is that almost all oil transactions are done in dollars...the reserve currency of the world...and therefore we have an inherent advantage/bonus for petroleum transactions. Once we lose that status, our oil will go up to where everyone else is in the world. Remember what it was like when gas hit $4.00 plus a gallon? What will happen when it goes up to $6.00...or $7.00. How about if it does that within, say...1 month?

Commodities are the only hedge against this type of disaster. Buy on dips... and a dip is a dip ... is a dip. Silver, gold, copper...you name it. If it has value and can be traded, get u some.

Ever wonder why our gas is 3-4 dollars a gallon and everyone else in the world pays 6-7 dollars a gallon?

The reason is that almost all oil transactions are done in dollars...the reserve currency of the world...and therefore we have an inherent advantage/bonus for petroleum transactions. Once we lose that status, our oil will go up to where everyone else is in the world. Remember what it was like when gas hit $4.00 plus a gallon? What will happen when it goes up to $6.00...or $7.00. How about if it does that within, say...1 month?

Commodities are the only hedge against this type of disaster. Buy on dips... and a dip is a dip ... is a dip. Silver, gold, copper...you name it. If it has value and can be traded, get u some.

Interesting thread.

I was in a coin shop today, with SE's laid out on the counter, trying to decide what to buy. I just couldn't pull the trigger. Something came over me, and I got the feeling inside of me that "this is a bad move and idea."

At $29 for a SE...it will be interesting to see in a few years if I made a mistake or not.

I was in a coin shop today, with SE's laid out on the counter, trying to decide what to buy. I just couldn't pull the trigger. Something came over me, and I got the feeling inside of me that "this is a bad move and idea."

At $29 for a SE...it will be interesting to see in a few years if I made a mistake or not.

FreedomUIC

Bronze Member

clovis97 said:Interesting thread.

I was in a coin shop today, with SE's laid out on the counter, trying to decide what to buy. I just couldn't pull the trigger. Something came over me, and I got the feeling inside of me that "this is a bad move and idea."

At $29 for a SE...it will be interesting to see in a few years if I made a mistake or not.

$29.00 for an Silver Eagle.....I would have pulled the trigger on every one the dealer had. I am long term bullish(as they say) on silver and expect to hold for at least 10 years.

Canadian Silver Maples have fallen below $30.00 for about five minutes, snagged some of those as well.

jim4silver

Silver Member

clovis97 said:Interesting thread.

I was in a coin shop today, with SE's laid out on the counter, trying to decide what to buy. I just couldn't pull the trigger. Something came over me, and I got the feeling inside of me that "this is a bad move and idea."

At $29 for a SE...it will be interesting to see in a few years if I made a mistake or not.

It will be interesting to see how far this "correction" takes us. I am hoping for below 20 bucks, but I don't know for sure if it will drop that far. I do think we will see 23 bucks or so before it takes off again. If we are in a longer term correction, then below 20 bucks is a done deal. Only thing is we won't know until it happens.

I have purchased some gold in the past few days, but will not buy silver unless it falls further.

Jim

FreedomUIC

Bronze Member

jim4silver said:clovis97 said:Interesting thread.

I was in a coin shop today, with SE's laid out on the counter, trying to decide what to buy. I just couldn't pull the trigger. Something came over me, and I got the feeling inside of me that "this is a bad move and idea."

At $29 for a SE...it will be interesting to see in a few years if I made a mistake or not.

It will be interesting to see how far this "correction" takes us. I am hoping for below 20 bucks, but I don't know for sure if it will drop that far. I do think we will see 23 bucks or so before it takes off again. If we are in a longer term correction, then below 20 bucks is a done deal. Only thing is we won't know until it happens.

I have purchased some gold in the past few days, but will not buy silver unless it falls further.

Jim

I am seriously considering purchasing more Gold. People are turning Gold into Silver like you wouldn't believe. The premium on an Gold Eagle is through the roof, although the most purest, Maples, are closer to spot. I guess I am in agreement with you.

But as a side note, I am buying all the Silver I can get as well. I plan on holding for at least 10 if not 15 years so right now the price

isn't scaring me like it does the short time investors. I look at it as a supplement to my retirement....

jim4silver

Silver Member

FreedomUIC said:jim4silver said:clovis97 said:Interesting thread.

I was in a coin shop today, with SE's laid out on the counter, trying to decide what to buy. I just couldn't pull the trigger. Something came over me, and I got the feeling inside of me that "this is a bad move and idea."

At $29 for a SE...it will be interesting to see in a few years if I made a mistake or not.

It will be interesting to see how far this "correction" takes us. I am hoping for below 20 bucks, but I don't know for sure if it will drop that far. I do think we will see 23 bucks or so before it takes off again. If we are in a longer term correction, then below 20 bucks is a done deal. Only thing is we won't know until it happens.

I have purchased some gold in the past few days, but will not buy silver unless it falls further.

Jim

I am seriously considering purchasing more Gold. People are turning Gold into Silver like you wouldn't believe. The premium on an Gold Eagle is through the roof, although the most purest, Maples, are closer to spot. I guess I am in agreement with you.

But as a side note, I am buying all the Silver I can get as well. I plan on holding for at least 10 if not 15 years so right now the price

isn't scaring me like it does the short time investors. I look at it as a supplement to my retirement....

I am with you on the positive long term silver outlook. I have not been putting much $$$ into PMs in the past 6 months, but when I do buy I have been getting old US gold, mostly certified stuff. The premiums have come down alot on them.

I am not a fan of "numismatic" stuff, but when I can get a 100+ year old coin in AU or MS condition and only pay a couple of hundred over spot (on the double eagles in MS), I think it is a good deal. At some time in the future when gold goes up I believe old US gold will take off again like it did a year ago. In any event, it is still gold and even at melt I will make a profit if gold goes up a little more in the coming years.

What I don't get is people paying $2000+ for some ugly (in my opinion) 5 ounce frisbees of silver that were just made this year (25 ounces of silver for how much

). But who am I to judge?

). But who am I to judge?Jim

FreedomUIC

Bronze Member

jim4silver said:jeff of pa said:I Won't buy till it hits $5.00

Then I'll but 10OZ. bars as often as I Can afford

I like 10 oz bars too. If silver ever makes it to 5 bucks I think the bull market will clearly be over at that time. I wish I was into buying silver back when it was 5 bucks in the past.

Jim

I don't think you will ever see 5.00 silver again. I doubt you will see 20 silver again either. Silver is expendable and our supply right now is about exhausted, either through industry or private collecting and with China letting their residents collect PM's the outlook for more is even bleaker. I am predicting $100.00 silver within the next 12 - 15 years.

Seajay

Full Member

- Joined

- Jul 6, 2003

- Messages

- 149

- Reaction score

- 2

- Golden Thread

- 0

- Location

- Eastern North Carolina

- Detector(s) used

- White's XLT, Garrett's CX w/Bloodhound, GTA 500, Whites PI

Guys,

We are going throught the aftermath of a housing bubble, but don't forget about the commercial real estate bubble. That one is next and could do additional harm to the so-called recovery. Also, a number of forclosures were not carried out in late 2010 because the banks/lending companies had to go through their paperwork to ensure it was completely correct before sending them to delinquent borrowers. That just delayed them until 2011. Then there is CA, NY, and the Lord only knows who else will come groveling for a bailout. Yeah, gold, and especially silver, has a lot of potential to go up.

yeah, and possibly more of that QE stuff mentioned above. Anyway, silver is at $27.99 with 11 minutes until the close.

Seajay

We are going throught the aftermath of a housing bubble, but don't forget about the commercial real estate bubble. That one is next and could do additional harm to the so-called recovery. Also, a number of forclosures were not carried out in late 2010 because the banks/lending companies had to go through their paperwork to ensure it was completely correct before sending them to delinquent borrowers. That just delayed them until 2011. Then there is CA, NY, and the Lord only knows who else will come groveling for a bailout. Yeah, gold, and especially silver, has a lot of potential to go up.

yeah, and possibly more of that QE stuff mentioned above. Anyway, silver is at $27.99 with 11 minutes until the close.

Seajay

Similar threads

- Replies

- 9

- Views

- 660

Users who are viewing this thread

Total: 1 (members: 0, guests: 1)