You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Bullion up to 60 Cents an ounce ... may even go Higher !!! WOO HOO !!!!!

- Thread starter jeff of pa

- Start date

jim4silver

Silver Member

- Apr 15, 2008

- 3,662

- 495

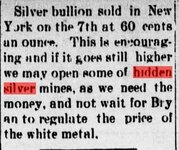

Watauga Democrat. (Boone, Watauga County, N.C.), 16 Dec. 1897.

View attachment 1163171

I could afford a few Silver Eagles at that price

I wonder what that would be in today's dollars?

Jim

- Thread starter

- #3

considering they would open a Mine at that Price.

Must be pretty Good

Must be pretty Good

- Thread starter

- #5

$1 of 1897 dollars would be worth: $17.14 in 2014

$1 of 2014 dollars would be worth $0.02 in 1897

Inflation Calculator 2015

$1 of 2014 dollars would be worth $0.02 in 1897

Inflation Calculator 2015

Goose-0

Hero Member

And JPM & others hammered the silver price today (Tue-5-19-15 - 11:30 am CDT).....down .50 +/- cents....3%. (Golly, how did that happen? We all know.)

For .60 cents in 1897 it's worth $16.81 in 2014. At $17.05 now, we're a little ahead of inflation.

For .60 cents in 2014 was worth .02 cents in 1897.

For .60 cents in 1897 it's worth $16.81 in 2014. At $17.05 now, we're a little ahead of inflation.

For .60 cents in 2014 was worth .02 cents in 1897.

Last edited:

bradley1719

Full Member

- Oct 26, 2014

- 108

- 41

- Primary Interest:

- All Treasure Hunting

And JPM & others hammered the silver price today (Tue-5-19-15 - 11:30 am CDT).....down .50 +/- cents....3%. (Golly, how did that happen? We all know.)

For .60 cents in 1897 it's worth $16.81 in 2014. At $17.05 now, we're a little ahead of inflation.

For .60 cents in 2014 was worth .02 cents in 1897.

So the price went UP by $1.00 in two days and no one screamed "manipulation". Apparently, that type of price action is completely "normal and expected" if you are a silver bull. But the price drops back DOWN by $0.50 in two days following the price jump and "Golly, how did that happen?".

I guess manipulation can only work in one direction. Note: I'm not saying that anything that has happened in the past week has been the result of manipulation. I just find it funny that silver bulls only see manipulation as something that can happen to the downside.

By the way.... if you look at a historical silver chart from 1792 to 1999 (look at Kitco's charts) you will see that $0.60 in 1897 was a relative "low" for that time period. From 1792 to 1886 the price stayed above $1.00 an ounce. It then dropped down to around the $0.50 range for many years. It stayed below $1.00 until 1961 (except for 1918-1919 where it went above $1.00 temporarily for two years before crashing back down again). So on average, $0.60 was about half of what it was from 1792 to 1886 (around $1.293 with fluctuations up and down).

So this implies that they had previously closed many mines because the price had dropped way down and those mines weren't profitable at the $0.60 range. But if the price went up significantly beyond that price they would consider opening those mines back up. I also wonder what they mean by "not wait for Bryan to regulate the price of the white metal". This looks like more manipulation talk from the silver bulls. Funny... even back then they were very closed minded about manipulation. The price of silver was pegged around $1.293 from 1792 to 1861 (almost 70 years) and no one talked about how that had to be "manipulation" by the government. The gold and silver standards of that time were the most massive (and effective) effort to manipulate PM prices ever known to man. And yet... not a peep out of the silver bulls about that. But the price drops down to $0.60 and they start screaming about "regulating the price of the white metal". When the price is $1.293 that manipulation is just fine. But when the price is $0.60 then that manipulation is evil. Go figure. I guess things never really change in this world. Silver bulls will be silver bulls no matter what generation they are born into.

- Thread starter

- #8

Small price drops & rises are Normal.

I'm not so sure Rising to $50. then all the way down to $17. is not manipulation.

Just like Oil & Gas Prices.

Ever time I drive by a gas Station it's up another Ten Cents around here.

that's Twice maybe 3 times as fast as it went down.

It only dropped 3 to 5 cents at a time

I'm not so sure Rising to $50. then all the way down to $17. is not manipulation.

Just like Oil & Gas Prices.

Ever time I drive by a gas Station it's up another Ten Cents around here.

that's Twice maybe 3 times as fast as it went down.

It only dropped 3 to 5 cents at a time

bradley1719

Full Member

- Oct 26, 2014

- 108

- 41

- Primary Interest:

- All Treasure Hunting

Small price drops & rises are Normal.

I'm not so sure Rising to $50. then all the way down to $17. is not manipulation.

Just like Oil & Gas Prices.

Ever time I drive by a gas Station it's up another Ten Cents around here.

that's Twice maybe 3 times as fast as it went down.

It only dropped 3 to 5 cents at a time

But doesn't this just prove what I'm talking about? The rise from $17 to $50 wasn't manipulation, but the fall from $50 to $17 is? How did the price get to $50 in the first place? Why don't the silver bulls consider THAT to be the manipulation? It's easy... you WANT the price of silver to be high. So when it does what you want it to do, you are happy and don't want to rock the boat. When the price of silver falls you get mad and try to find someone to blame it on. So it seems logical to you that some external force must be pushing it down. What other answer could there be right? Note: I'm NOT saying that the price of silver when to $50 due to manipulation. I'm just trying to show the illogical nature of how some silver bulls think.

Same thing with gas prices (but opposite). You WANT gas prices to be low. So when the price of gas dropped significantly, did you scream manipulation? Nope. But now that the gas prices are going back up you are talk about how it is going up 3 times as fast as it went down and implying that this is potentially some sort of manipulation. Is this logical? Why isn't the massive fall in gas prices considered to be due to manipulation? Again, I'm not saying it is. I'm just saying that it is odd that you never even considered it.

Looking at the 1897 example, we see the same thing. Silver was PEGGED at $1.293 by the government in order to get a gold to silver ratio of 16:1. But this ratio is arguably not right at all. That ratio in modern times has gone between 35:1 and 70:1 (today). Now I'm not a big fan of gold to silver ratios. But you can get some interesting information from them if you simply look at them with respect to each other. And looking at these values it seems apparent to me that a 16:1 ratio was ridiculous. It was fabricated by the government. So this means the $1.293 price was likely WAY too high and was nowhere near where the market would have put it without government control.

But did the silver miners complain when the government pegged the price at what was likely at least twice as high as it should have been? Nope. But they complained when the government STOPPED manipulating the price and let it fall down to a much more reasonable level around $0.60. They completely ignored the fact that silver had no business being at $1.293 for all those years. But as soon as their gravy train dries up they starting crying foul...

It's completely comical. I just don't understand how so many silver bulls can apparently not see this phenomenon.

jim4silver

Silver Member

- Apr 15, 2008

- 3,662

- 495

Small price drops & rises are Normal.

I'm not so sure Rising to $50. then all the way down to $17. is not manipulation.

Just like Oil & Gas Prices.

Ever time I drive by a gas Station it's up another Ten Cents around here.

that's Twice maybe 3 times as fast as it went down.

It only dropped 3 to 5 cents at a time

What is your problem Jeff? Don't you know there is NO manipulation in the silver and gold market. There is however, PROVEN manipulation in the currency markets, oil markets, interest rate markets, etc. etc. Banks and financial institutions paying BILLIONS in fines for these proven manipulations. Silver is a much smaller market than any of these others, so any manipulation will have a larger impact than in larger markets. But we all know there is NO silver or gold manipulation.

PS Where else can you sell something you don't own and further, the amount of the thing you sell that you don't own, is in much larger amounts than is immediately available to deliver? But that is a-OK. Naked short selling to the max I say.

Some recent examples of manipulation in other markets.

JPMorgan (JPM), Citigroup (C) Among Banks Fined $2.5 Billion in Currency-Market Manipulation - TheStreet

UK and US regulators fine trader £3m for manipulation of oil market - Telegraph

Libor (Barclays Interest Rate Manipulation Case)

Just my opinion.

Jim

jim4silver

Silver Member

- Apr 15, 2008

- 3,662

- 495

But doesn't this just prove what I'm talking about? The rise from $17 to $50 wasn't manipulation, but the fall from $50 to $17 is? How did the price get to $50 in the first place? Why don't the silver bulls consider THAT to be the manipulation? It's easy... you WANT the price of silver to be high. So when it does what you want it to do, you are happy and don't want to rock the boat. When the price of silver falls you get mad and try to find someone to blame it on. So it seems logical to you that some external force must be pushing it down. What other answer could there be right? Note: I'm NOT saying that the price of silver when to $50 due to manipulation. I'm just trying to show the illogical nature of how some silver bulls think.

Same thing with gas prices (but opposite). You WANT gas prices to be low. So when the price of gas dropped significantly, did you scream manipulation? Nope. But now that the gas prices are going back up you are talk about how it is going up 3 times as fast as it went down and implying that this is potentially some sort of manipulation. Is this logical? Why isn't the massive fall in gas prices considered to be due to manipulation? Again, I'm not saying it is. I'm just saying that it is odd that you never even considered it.

Looking at the 1897 example, we see the same thing. Silver was PEGGED at $1.293 by the government in order to get a gold to silver ratio of 16:1. But this ratio is arguably not right at all. That ratio in modern times has gone between 35:1 and 70:1 (today). Now I'm not a big fan of gold to silver ratios. But you can get some interesting information from them if you simply look at them with respect to each other. And looking at these values it seems apparent to me that a 16:1 ratio was ridiculous. It was fabricated by the government. So this means the $1.293 price was likely WAY too high and was nowhere near where the market would have put it without government control.

But did the silver miners complain when the government pegged the price at what was likely at least twice as high as it should have been? Nope. But they complained when the government STOPPED manipulating the price and let it fall down to a much more reasonable level around $0.60. They completely ignored the fact that silver had no business being at $1.293 for all those years. But as soon as their gravy train dries up they starting crying foul...

It's completely comical. I just don't understand how so many silver bulls can apparently not see this phenomenon.

You must not read my posts. I have said for a long time there is manipulation BOTH ways. It is the system itself that allows and encourages manipulation. So I guess one can say "don't hate the players, hate the game".

And yes the 16 to 1 ratio was a form of manipulation since it was enforced by the governments of the world for many years, however not unlike how the Fed reserve today controls interest rates and leaves them at zero for years, etc.

PS And I have said the drop in oil (and thus gas prices) is due to "manipulation" via sanctions, etc, due to the Ukraine situation. As we see relative peace there the oil price jumps up 20%+ since the recent low.

Just my opinion.

Jim

Last edited:

- Thread starter

- #12

But doesn't this just prove what I'm talking about? The rise from $17 to $50 wasn't manipulation, but the fall from $50 to $17 is? How did the price get to $50 in the first place? Why don't the silver bulls consider THAT to be the manipulation? It's easy... you WANT the price of silver to be high. So when it does what you want it to do, you are happy and don't want to rock the boat. When the price of silver falls you get mad and try to find someone to blame it on. So it seems logical to you that some external force must be pushing it down. What other answer could there be right? Note: I'm NOT saying that the price of silver when to $50 due to manipulation. I'm just trying to show the illogical nature of how some silver bulls think.

Same thing with gas prices (but opposite). You WANT gas prices to be low. So when the price of gas dropped significantly, did you scream manipulation? Nope. But now that the gas prices are going back up you are talk about how it is going up 3 times as fast as it went down and implying that this is potentially some sort of manipulation. Is this logical? Why isn't the massive fall in gas prices considered to be due to manipulation? Again, I'm not saying it is. I'm just saying that it is odd that you never even considered it.

Looking at the 1897 example, we see the same thing. Silver was PEGGED at $1.293 by the government in order to get a gold to silver ratio of 16:1. But this ratio is arguably not right at all. That ratio in modern times has gone between 35:1 and 70:1 (today). Now I'm not a big fan of gold to silver ratios. But you can get some interesting information from them if you simply look at them with respect to each other. And looking at these values it seems apparent to me that a 16:1 ratio was ridiculous. It was fabricated by the government. So this means the $1.293 price was likely WAY too high and was nowhere near where the market would have put it without government control.

But did the silver miners complain when the government pegged the price at what was likely at least twice as high as it should have been? Nope. But they complained when the government STOPPED manipulating the price and let it fall down to a much more reasonable level around $0.60. They completely ignored the fact that silver had no business being at $1.293 for all those years. But as soon as their gravy train dries up they starting crying foul...

It's completely comical. I just don't understand how so many silver bulls can apparently not see this phenomenon.

No I believe the rise was Manipulated too

- Thread starter

- #13

one last Word on this for me.

I'm not too Proud to say.

Manipulation which Helps Me is OK By Me.

Manipulation that Hurts Me... is Just Wrong

I'm not too Proud to say.

Manipulation which Helps Me is OK By Me.

Manipulation that Hurts Me... is Just Wrong

bradley1719

Full Member

- Oct 26, 2014

- 108

- 41

- Primary Interest:

- All Treasure Hunting

one last Word on this for me.

I'm not too Proud to say.

Manipulation which Helps Me is OK By Me.

Manipulation that Hurts Me... is Just Wrong

As long as you are willing to admit it then I can respect that. And I completely understand why someone would feel that way. It is natural.

bradley1719

Full Member

- Oct 26, 2014

- 108

- 41

- Primary Interest:

- All Treasure Hunting

You must not read my posts. I have said for a long time there is manipulation BOTH ways. It is the system itself that allows and encourages manipulation. So I guess one can say "don't hate the players, hate the game".

And yes the 16 to 1 ratio was a form of manipulation since it was enforced by the governments of the world for many years, however not unlike how the Fed reserve today controls interest rates and leaves them at zero for years, etc.

PS And I have said the drop in oil (and thus gas prices) is due to "manipulation" via sanctions, etc, due to the Ukraine situation. As we see relative peace there the oil price jumps up 20%+ since the recent low.

Just my opinion.

Jim

Then I can respect that. As long as you are willing to see the potential for manipulation both ways then you are not the typical silver bull.

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)