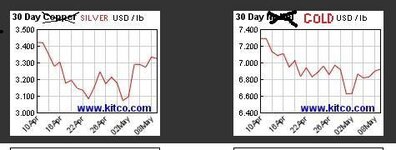

Unprecedented demand for physical gold does not even seem to be having any impact at all on the metal price as high frequency traders rule the day. Illogical!

Mr Spock would definitely find current gold price levels illogical - GOLD ANALYSIS - Mineweb.com Mineweb

Mr Spock would definitely find current gold price levels illogical - GOLD ANALYSIS - Mineweb.com Mineweb

. However, as the old saying goes "money talks, BS walks".

. However, as the old saying goes "money talks, BS walks".

.

.