Peyton Manning

Gold Member

- Dec 19, 2012

- 14,540

- 18,696

- 🏆 Honorable Mentions:

- 1

- Detector(s) used

-

MXT-PRO

Sandshark

- Primary Interest:

- Metal Detecting

I keep all I find and have bought Morgan’s and eagles.

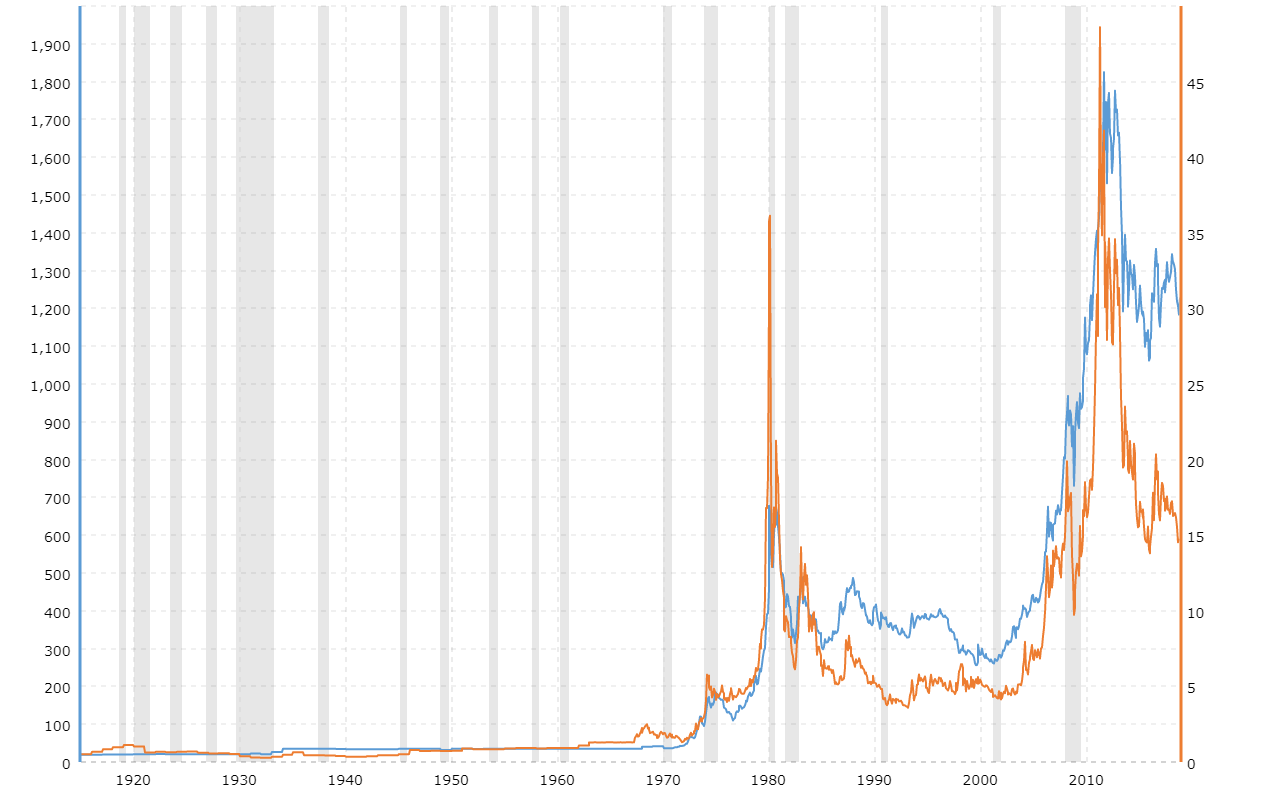

But a friend has been on me to buy gold, but lately silver.

So, today I bought 20 more 64 Kennedy halves.

Anyone else think silver is going high?

I got these at a teller a while back for face.

But a friend has been on me to buy gold, but lately silver.

So, today I bought 20 more 64 Kennedy halves.

Anyone else think silver is going high?

I got these at a teller a while back for face.