You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SB637 rammed through the assembly

- Thread starter Reed Lukens

- Start date

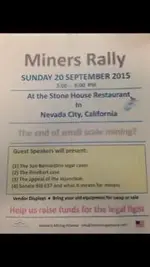

WMA MEETING

next Sunday from 5 to 8pm at the Stone House in Nevada City

http://www.treasurenet.com/forums/asset.php?fid=988479&uid=51084&d=1442034297

Reed...link does not work. Tell us more.

- Joined

- Jan 1, 2013

- Messages

- 2,664

- Reaction score

- 5,461

- Golden Thread

- 0

- Detector(s) used

- Tesoro Vaquero, Whites MXT, Vsat, GMT, 5900Di Pro, Minelab GPX 5000, GPXtreme, 2200SD, Excalibur 1000!

- Primary Interest:

- All Treasure Hunting

- #22

Thread Owner

I'm not home so I'm using Karen's iPad... It's a picture of the add for the meeting next Sunday. It's at the stone house restaurant in Nevada city right off 49 where the other WMA meetings have been held recently. Every miner needs to be here next Sunday. Lots of guest speakers, bring your equipment that you want to trade / sell, etc.Reed...link does not work. Tell us more.

When I get home I will repost the add unless one of you can see it and fix the link or add the pic

How many politician's were invited? We need to start working them like Dizzy does. we need them to know the true facts of all of this.

russau

Gold Member

- Joined

- May 29, 2005

- Messages

- 7,917

- Reaction score

- 7,854

- Golden Thread

- 0

- Location

- St. Louis, missouri

WAY to far for me to go!

Goldwasher

Gold Member

- Joined

- May 26, 2009

- Messages

- 6,084

- Reaction score

- 13,254

- Golden Thread

- 1

- Location

- Sailor Flat, Ca.

- 🥇 Banner finds

- 1

- Detector(s) used

- SDC2300, Gold Bug 2 Burlap, fish oil, .35 gallons of water per minute.

- Primary Interest:

- All Treasure Hunting

How many politician's were invited? We need to start working them like Dizzy does. we need them to know the true facts of all of this.

Very good point we don't need to convince ourselves!! what about local off roaders non elite fisherman...and other people who could have a stake someway...I realize a lot of theses guys are against this stuff and many who don't know would be.... Also what about trying to get someone from the news there? I live up near Georgetown I'll see if I can get in touch with someone at jeepers jamboree they have an office up here.

Also is this posted on facebook?..MCN or California prospectors and miners page I'll check and put up a link.

I'll see you guys there.

2cmorau

Bronze Member

- Joined

- Nov 8, 2010

- Messages

- 1,608

- Reaction score

- 1,294

- Golden Thread

- 0

- Location

- Camptonville, CA

- Detector(s) used

- GMT&GM3 Whites MXT Pro, Shadow X5, Fisher 1280, OMG and the TDI

- Primary Interest:

- Prospecting

2cmorau

Bronze Member

- Joined

- Nov 8, 2010

- Messages

- 1,608

- Reaction score

- 1,294

- Golden Thread

- 0

- Location

- Camptonville, CA

- Detector(s) used

- GMT&GM3 Whites MXT Pro, Shadow X5, Fisher 1280, OMG and the TDI

- Primary Interest:

- Prospecting

goldenIrishman

Silver Member

- Joined

- Feb 28, 2013

- Messages

- 3,465

- Reaction score

- 6,154

- Golden Thread

- 0

- Location

- Golden Valley Arid-Zona

- Detector(s) used

- Fisher / Gold Bug AND the MK-VII eyeballs

- Primary Interest:

- Other

credit Mr Gregor

Too close to the truth! As long as there's money from government programs and grants to be made by the environuts they're going to keep fighting us over who can get more mercury out of the watersheds. Cut off the funding and you can pretty much guarantee the groups like TSF will dry up and blow away.

2cmorau

Bronze Member

- Joined

- Nov 8, 2010

- Messages

- 1,608

- Reaction score

- 1,294

- Golden Thread

- 0

- Location

- Camptonville, CA

- Detector(s) used

- GMT&GM3 Whites MXT Pro, Shadow X5, Fisher 1280, OMG and the TDI

- Primary Interest:

- Prospecting

http://wattsupwiththat.com/2014/09/...lub-foundation-accused-of-tax-law-violations/

FOR IMMEDIATE RELEASE –

E&E Legal Files Referral With IRS Regarding Sierra Club and Sierra Club Foundation Tax Law Violations

Washington, D.C. – Today, the Energy & Environment Legal Institute (E&E Legal) filed a formal referral with the Internal Revenue Service alleging the Sierra Club and the Sierra Club Foundation are in potential noncompliance regarding two areas of tax law: impermissible benefit to private interests and failure to pay taxes on unrelated business income. A detailed report authored by E&E Legal’s General Counsel David W. Schnare outlining the specific violations accompanied the IRS referral, which seeks the tax agency’s careful review and investigation into these potential tax law violations.

FOR IMMEDIATE RELEASE –

E&E Legal Files Referral With IRS Regarding Sierra Club and Sierra Club Foundation Tax Law Violations

Washington, D.C. – Today, the Energy & Environment Legal Institute (E&E Legal) filed a formal referral with the Internal Revenue Service alleging the Sierra Club and the Sierra Club Foundation are in potential noncompliance regarding two areas of tax law: impermissible benefit to private interests and failure to pay taxes on unrelated business income. A detailed report authored by E&E Legal’s General Counsel David W. Schnare outlining the specific violations accompanied the IRS referral, which seeks the tax agency’s careful review and investigation into these potential tax law violations.

Last edited:

Armchair prospector

Sr. Member

My dredge is in my shed which is within 30 yards of the Cosumnes river.

fowledup

Silver Member

- Joined

- Jul 21, 2013

- Messages

- 2,757

- Reaction score

- 5,163

- Golden Thread

- 0

- Location

- Northern California

- Detector(s) used

- Whites GMT V/SAT

- Primary Interest:

- Prospecting

Sierra Club and Sierra Club Foundation Accused of Tax Law Violations | Watts Up With That?

FOR IMMEDIATE RELEASE –

E&E Legal Files Referral With IRS Regarding Sierra Club and Sierra Club Foundation Tax Law Violations

Washington, D.C. – Today, the Energy & Environment Legal Institute (E&E Legal) filed a formal referral with the Internal Revenue Service alleging the Sierra Club and the Sierra Club Foundation are in potential noncompliance regarding two areas of tax law: impermissible benefit to private interests and failure to pay taxes on unrelated business income. A detailed report authored by E&E Legal’s General Counsel David W. Schnare outlining the specific violations accompanied the IRS referral, which seeks the tax agency’s careful review and investigation into these potential tax law violations.

Wonder if these folks would be interested in looking into the Sierra Fraud.......I meant "Fund", honest I did.

goldenIrishman

Silver Member

- Joined

- Feb 28, 2013

- Messages

- 3,465

- Reaction score

- 6,154

- Golden Thread

- 0

- Location

- Golden Valley Arid-Zona

- Detector(s) used

- Fisher / Gold Bug AND the MK-VII eyeballs

- Primary Interest:

- Other

I'll make comment as soon as I can stop laughing at how the universe (aka Karma) is getting ready to take a big bite out of the Sierra Clubs backside.

Ok... That's enough (for now)

Follow the money and thou shalt find the truth! I agree with Fowled in that TSF also needs a good close looking at as well. Between political lobbying and supporting specific candidates that are in line with the TSF agenda there has got to be something that could be used to bring Izzy and her fan club down.

Ok... That's enough (for now)

Follow the money and thou shalt find the truth! I agree with Fowled in that TSF also needs a good close looking at as well. Between political lobbying and supporting specific candidates that are in line with the TSF agenda there has got to be something that could be used to bring Izzy and her fan club down.

Goldwasher

Gold Member

- Joined

- May 26, 2009

- Messages

- 6,084

- Reaction score

- 13,254

- Golden Thread

- 1

- Location

- Sailor Flat, Ca.

- 🥇 Banner finds

- 1

- Detector(s) used

- SDC2300, Gold Bug 2 Burlap, fish oil, .35 gallons of water per minute.

- Primary Interest:

- All Treasure Hunting

I know Izzy was sent a letter that there is a complaint about their lobbying...in consideration of their non profit status

Oakview2

Silver Member

- Joined

- Feb 4, 2012

- Messages

- 2,807

- Reaction score

- 3,348

- Golden Thread

- 0

- Location

- Prather CA

- Detector(s) used

- Whites GMT

- Primary Interest:

- Other

Sierra Club and Sierra Fund, two separate snake pits

Similar threads

- Replies

- 1

- Views

- 463

- Suggestion

- Replies

- 6

- Views

- 768

- Replies

- 2

- Views

- 1K

Users who are viewing this thread

Total: 1 (members: 0, guests: 1)